FINANCING AND CREDIT

Banks offer loans and financing for personal and business needs, such as mortgages, personal loans, and project financing. Credit assessments are usually required, so the borrower’s financial status is a crucial factor.

Types of loans

Loans to Foreigners

US banks are less demanding with foreign banks

Resident Loan

Mortgage Application for US Citizens and Residents

Private Loan

Private real estate loans with the property as collateral

OUR PROCESS

We make it easy!

Initial consultation

The first thing is to understand your situation and your objectives, to choose the best work plan that allows you to obtain the results you expect.

Documents delivery

Loan pre-approval requires verification of income, employment, assets and debts. We tell you how to do it without fail.

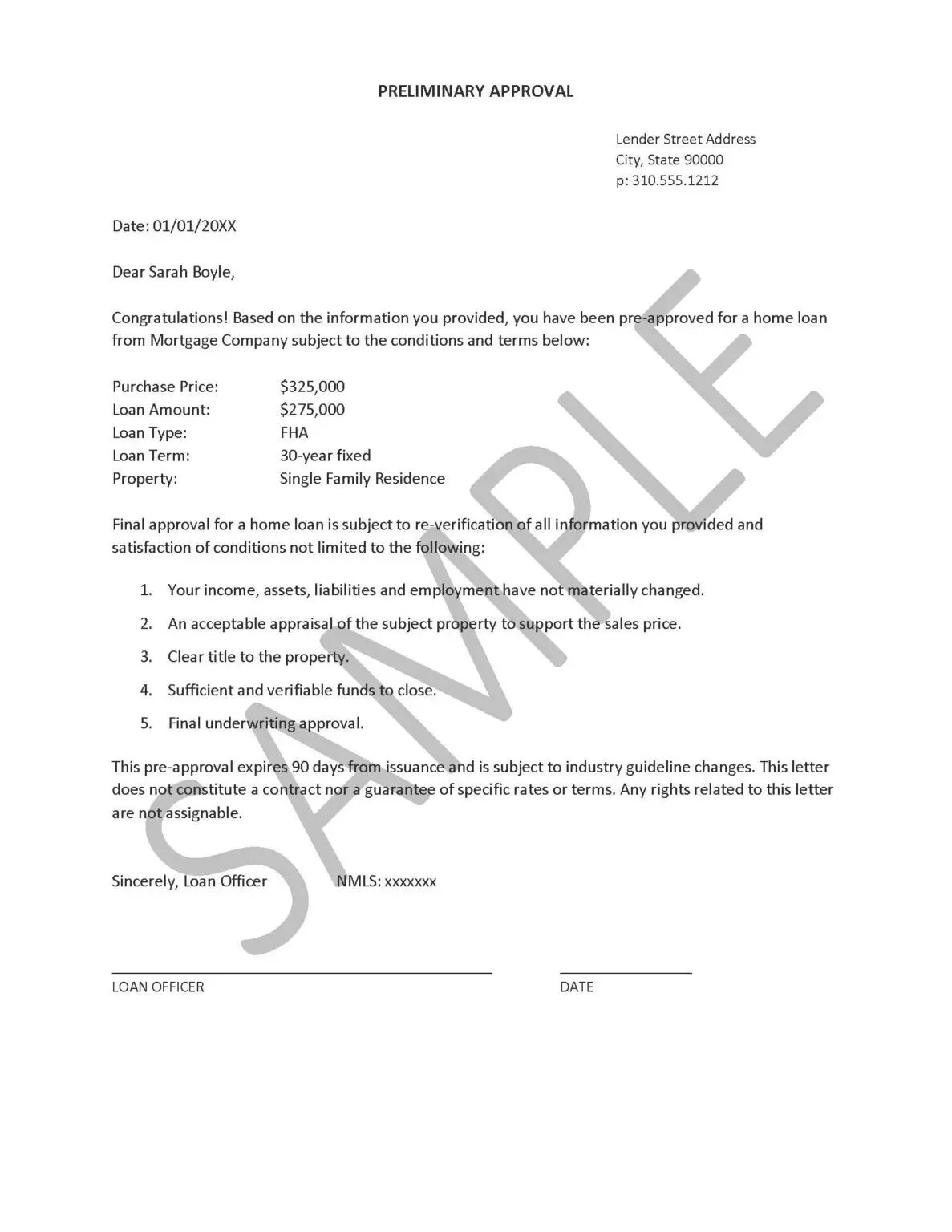

Get approval

It is important to present your loan approval letter to the agents to demonstrate that you have obtained the necessary collateral to purchase.

Search property

Now we can help you get the properties with the best profitability, value or that meet the objectives you want.

Application

With the property under contract, we are ready to apply for the loan. You can apply online, by phone, or in person. We are already close!

Processing and Final Review

With all the Buyer and Property documentation, we proceed to review each of the Bank’s requirements and ensure that everything is in order.

QUICK METHODS

Prior Approval Letter

One of the reasons credit is so widely available in the U.S. is because we have a robust credit reporting system.